By following the money habits of the wealthy, anyone can change their circumstances and attitudes towards money. The wealthy have good money habits which, over time, make them wealthy and keep them wealthy. If you have some negative views on money, it’s worth considering how they might be holding you back.

The wealthy know how to manage their money. By following those who are successful, we can learn new ideas and strategies which may have kept us previously in monetary strife and difficulties!

Money Habits Of The Wealthy – 1, Pay Yourself First

Pay yourself first is a phrase used by the wealthy. Most people pay their bills, buy their weekly food shop and pay their rent before doing anything else when they get paid. Then, whatever is left, they spend on themselves! Often, this means you over spend and put yourself into your overdraft before the next pay day! This cycle continues and you slowly fall into debt!

The wealthy pay themselves first. Before they pay anyone anything, they put 10% of their income away into a savings account. This has a twofold benefit. Firstly they are accruing savings which will grow with interest over time (and which they can use for investments/business). But they are also learning how to live on less than they are earning – a very beneficial skillset!

Money Habits Of The Wealthy – 2, Live Beneath Your Means

Those aspiring to be wealthy will often spend money on those things they have always wanted. They buy the nice house and a nice car. They go on holidays twice a year. As their income grows, so does their lifestyle. They get a nicer car, a nicer house and go on holiday more often. They continue to increase their standard of living as their income grows.

The money habits of the wealthy are opposite to this! They continue to live well beneath their means while their income grows. This means they can re-invest capital into money generating assets, rather than spending them on liabilities which make them look rich, but actually drain their capital.

“The median price paid by millionaires for their most recent acquisition was only $31,367. The typical price paid by decamillionaires was $41,997, nowhere near the $75,000 figure it is assumed that rich people spend on cars.”

― Thomas J. Stanley, Stop Acting Rich: …And Start Living Like A Real Millionaire

Money Habits Of The Wealthy -3, Stop Acting Rich!

In David Bach’s book the automatic millionaire, he talks about “big hat no cattle”. It’s the same idea conveyed in Thomas Stanley’s book Stop Acting Rich. Big hat no cattle refers to the compulsion to express your success through purchasing large expensive cars and houses.

A rancher has a big hat, but also a large number of cattle. But someone without cattle is a metaphor for someone with no money who drives an expensive car, and wears an expensive watch to show off their wealth. When in reality, the truly wealthy don’t do this.

The wealthy know that they can use the money it would cost to buy these superficial things to re-invest in money producing assets instead, and grow their wealth faster.

4, Know Your Latte Factor

This is another principle mentioned in David Bach’s book The Automatic Millionaire. Your “latte factor” refers to those small daily purchases which add up over the years. A latte coffee and a biscuit might be justified at Starbucks but this can set you back $5! Over a year of purchasing a latte coffee and a biscuit every day would add up to $1825 in a year.

Take stock of your own “latte factor” and you will see how your unconscious spendings are costing you thousands each and every year. By reconciling these small spendings, and diverting the habits, you can pocket the cash instead. Set up an automated payment into a savings account for the amount you would spend after giving up one of your latte habits. This is now money which can be used to generate income either through investing or simply saving.

Most people live to their means and only draw back their spending when their bank account is in dire straights! By taking stock of your weekly spending habits, you can save yourself a fortune and become more aware of how your money is being spent. Make a note of every thing you spend money on for a week and you will be shocked at what you can save.

5, Use Savings For Investments

Over time you should start to see your savings growing. This will depend on your individual situation, but even a small shift should allow you to control your money better. Learn to save money you would otherwise spend and choose to put money aside first when you get it. You’ll soon start living beneath your means and see your savings grow.

This money can then be used for other savings, investments and opportunities to build income producing assets. See smart passive income ideas and extra income ideas from home.

The wealthy know that in order to grow their income and wealth they need to generate leverage. While working at a job produces a regular income, it’s always tied to the amount of hours they can work. This means trading time for money will always be limited. One way to generate some leverage is through building an online business. Access this webinar and learn how to generate an income online.

6, Build Multiple Income Streams

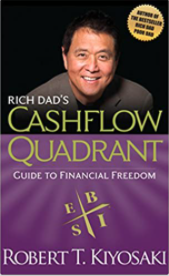

Most people are heavily relying on a single source of income, usually from an employer. When that income is threatened, they are very vulnerable. Their income is capped because they earn only through trading their time in a job. The wealthy, on the other hand build multiple sources of income through various strategies. Robert Kiyosaki talks about the the different means of earning in The Cash Flow Quadrant.

S = Self employed

I= Investments

E= Employment

B= Business

The wealthy have a broad spectrum of earning strategies which come from all four quadrants. They build multiple income strategies and can earn from self employment, employment, investments and from businesses. Most people only earn from one and it’s usually from employment.

Ultimately the goal of the wealthy is to create more income and gain better control over their time. The wealthy therefore live very simple and frugal lives for longer than they need to in order to generate cash flow. Without the extra cash flow you can’t invest in property, stocks and shares, businesses and other income producing assets. You end up tied to a job, living payday to payday but never escape the cycle because you live to your means!

7, Read – (Self Educate)

85% of rich people read two or more education, career-related, or self-improvement books per month, compared to 15% of poor people according to Tom Corley – author of “Rich Habits: The Daily Success Habits Of Wealthy Individuals.“

Corley’s research shows that both the wealthy and not so wealthy read. The difference is that the wealthy read for self improvement and the less so wealthy read for entertainment.